Oncology Learning Collaborative Partnership

Setting coverage and pricing for cancer care services is fraught with complications. Diagnostic testing and treatment over the last five years has rapidly expanded, with updates to health plan coverage not always keeping pace. There are wide variations in oncology care across settings and programs, including reimbursement challenges with increased billing errors that result from the use of wrong codes, denied claims needing appeals, and prior authorizations delaying care.

Employers are utilizing Centers of Excellence, direct contracting, and site of care strategies to better manage the cost of cancer treatment.

Employers should also consider financial burdens that are unique to women who have been diagnosed with cancer and implement strategies to mitigate these challenges.

The High Cost of Cancer Care

The costs of just a couple claims involving advanced cancer treatments could bankrupt a self-insured employer, while those that are fully insured are likely to experience significant premium increases. While stop-loss insurance is still being used by some employers, the insurance typically has limits well below the costs of cell and gene therapies, for example. As these therapies become available for treating more commonly occurring diseases, the insurance costs will most likely overshadow the risks of not having it.

Employers may force federal intervention by excluding coverage for multimillion-dollar therapies, limiting first-dollar primary coverage to employees only, or replacing their healthcare insurance benefits with employee payments to purchase external insurance.

Payment options are uncertain. Some insurers are considering outcomes-based contracts with employers, so the employer pays according to the outcome achieved. Manufacturers will be asking employers to take a risk and buy some insurance, and then they will receive the drug at a reasonable cost or free, depending on the arrangement. There is limited coverage by Medicare and Medicaid.

Questions to ask your medical carrier

- Is prior authorization required for coverage of cell and gene therapies?

- Is biomarker testing required when appropriate for cell and gene therapies to be approved for coverage?

- What are the rates of approved prior authorizations for coverage and appeals when coverage of cell and gene therapies are initially denied?

Site-of-Care

Employers can direct their plan members to use high-value services and sites of care through direct contracting arrangements with specific providers including centers of excellence. The real challenge for site-of-care is that there must be a trigger mechanism early in the diagnosis process to get patients connected to lower-cost, higher-quality providers. Patients can be identified through pharmacy claims, stop-loss carrier monitoring of cases, precertification/prior authorization, and patient self-identification. Employee Benefits Research Institute (EBRI) did a study that illustrates cost differences for oncology medicines based on site of treatment. Key findings include:

- Hospital prices for the top 37 infused cancer drugs averaged 86.2% more per unit than prices in physician offices.

- For every drug examined, hospital outpatient departments (HOPDs) charged more on average with statistically significant relative differences ranging from 128.3% (Nivolumab) to 428% (Fluorouracil).

- The mean annual reimbursement to providers per user of infused cancer drugs was $13,128 in physician offices and $21,881 in hospital outpatient departments (HOPDs).

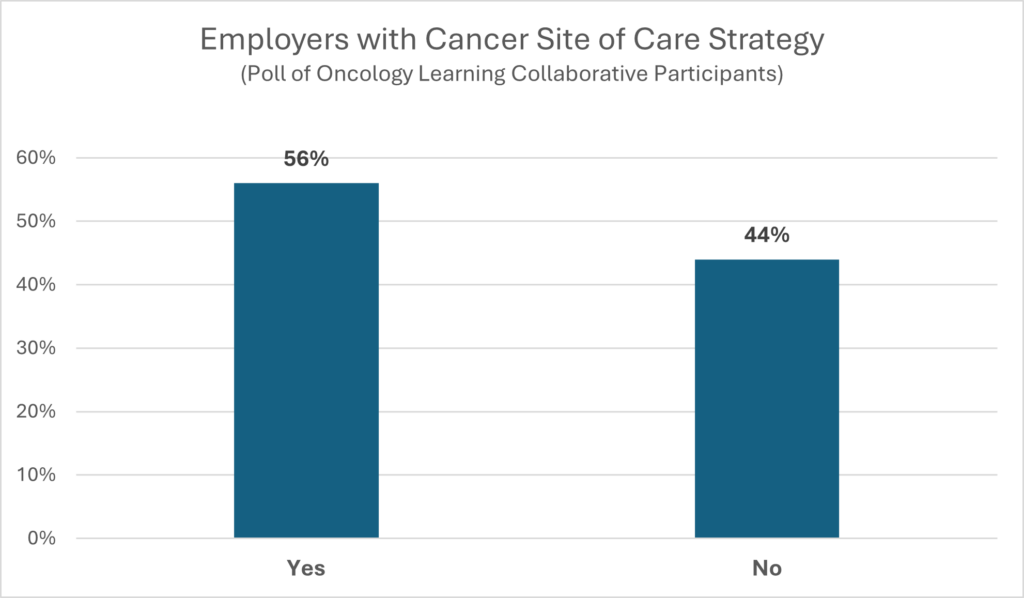

More than half (56%) of employers who participated in the OLC webinars say they are working on a site-of care strategy for cancer treatment.

Dan Dentzer, Manager of Health and Welfare Strategy, United Airlines

“Transitioning a patient from a local oncology physician to a COE is not always easy and the physician may not welcome consultations, but the doctors we use through our vendor partner, AccessHope, are the best in the nation so that helps. They are the ones who write textbooks and give presentations at medical conventions. Local doctors go to these doctors initially when they have a question. When these doctors say we have a patient together and I have reviewed the notes, the local doctor is more likely and willing to have the conversation. We also work with what was formerly called 2ndMD under the Accolade umbrella and they do some cancer COE or cancer second opinion services for us. With the Adult Outpatient Programs (AOP) that AccessHope offers, we find that 70% of the cases are adjusted and 90% of those cases are adjusted significantly. Our second opinion program saves the plan money. This is a rare win-win.”

Copay Accumulators, Maximizers and

Alternative Funding Programs

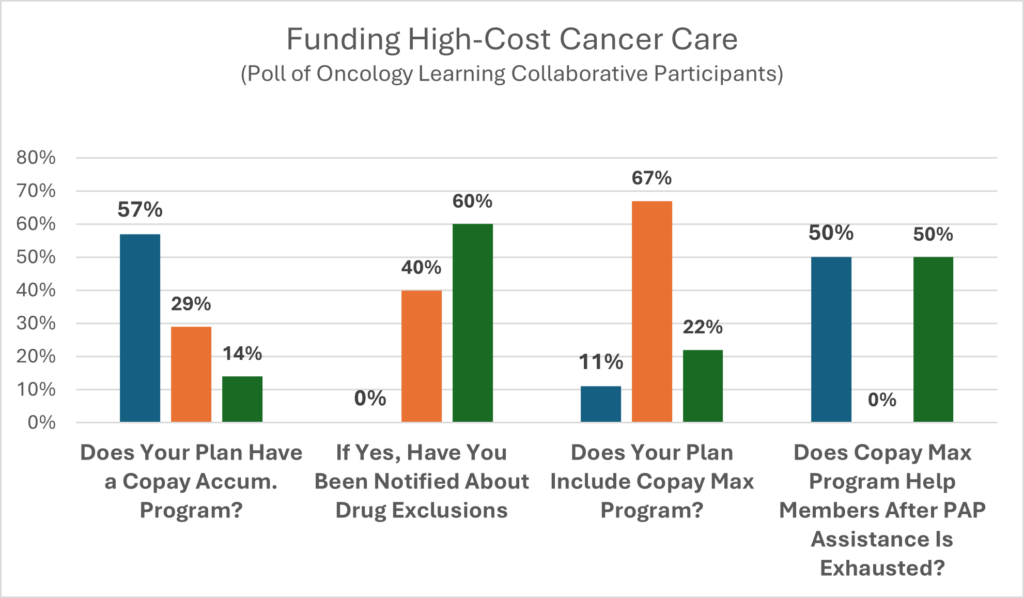

Cancer care involving prescription drugs typically falls within the top five most-costly healthcare benefits areas for employers and sends them scrambling for ready-made solutions to lower the costs. To help the uninsured, underinsured, and low-income patients access high-cost therapies, drug manufacturers established patient assistance programs (PAPs).

As plan fiduciaries, employers worried that PAPs were interfering with their ability to prudently manage plan assets and were equally concerned that falsely calculated employee cost-share for PAP participants predisposed them to claims of discriminatory plan management from members of specific disease states who were not privy to the PAPs. Employers were compelled to require PBMs and medical carriers to develop processes to track PAP payments for covered members to prevent them from being falsely counted as employee cost share.

Three common payment plans are:

Accumulator Programs. PAPs provide a capped dollar amount per patient that is not applied to a patient’s deductible/OOP Max. Once the PAP is exhausted, the patient becomes responsible for the total payment until the deductible is met, followed by copays or coinsurance until their maximum out-of-pocket limit is met.

Maximizer Programs – A capped amount of PAP funding is divided equally over the expected length of treatment months, thus reducing or eliminating the patient’s cost-share obligations.

Alternative Funding Programs – Specific high-cost drugs are eliminated from an employer’s plan coverage and are covered only when PAP assistance has been denied or designated as non-essential health benefits (non-EHB), making essentially all plan members eligible to apply for AFP assistance.

Recent Legislation

- Laws in 20 states and Puerto Rico address the use of copay adjustment programs by insurers or PBMs by requiring any payment or discount made by or on behalf of the patient be applied to a consumer’s annual out-of-pocket cost-sharing requirement.

- On a federal level, 1375-HELP Copays Act and H.R.830-HELP Copays Act were introduced to the 118 Congress, with both bills requiring health plans to apply third-party payments, financial assistance, discounts, product vouchers, and other reductions in patient’s out-of-pocket drug expenses toward their cost share limits.

- On September 29, 2023, the US District Court for the District of Columbia struck down a previous administrative rule that allowed health insurers to not count drug manufacturers’ copay assistance toward a patient’s out-of-pocket costs. This makes insurers unable to use copay accumulators for drugs without generic equivalents, thus allowing assistance to be counted as cost-sharing for those drugs. Federal Court Strikes Down HHS Rule on Copay Accumulator Programs | Maynard Nexsen – JDSupra.

It is important to collaborate with carriers to find out what they are doing about the September 29, 2023, decision and what it means to your plan. Employers should do this to make sure they are not going to be in violation of a decision that was effective on the date of enactment.

Employers Using AFPs Should Seek Legal Input

Employers should carefully evaluate associations with AFPs as issues concerning ERISA and IRS compliance are coming into play. The use of funds involving employee premiums to pay AFP administrative expenses may constitute a breach of fiduciary responsibilities under ERISA. Even if AFPs limit procurement of PAP funding to lower-income participants, plan benefits may become skewed toward highly compensated employees leading to tax code violations without taxation of these employees.

Employer Action Steps

- Involve legal, employee relations, employee, and risk-reduction representatives in the decision-making process.

- Ensure cost savings analyses include disclosed administrative fees as well as nondisclosed factors such as loss of rebates and patient cost share contributions, changes in network discounts based on sales volumes, fees related to communication of plan changes, etc.

- Seek input from employers with long-term experience using programs and vendors.

- Stay abreast of recent and pending lawsuits and legislation related to programs and vendors.

- Seek stakeholder (members, insurance carriers, etc.) input concerning the value of these programs and vendors.

MBGH Employer Action Brief: Copay Accumulators, Copay Maximizers, and Alternate Funding Programs: Friends or Foes? (Check back soon for this publication!)

Financial Challenges Women Face During the Cancer

Patient Journey

Deloitte’s report titled “Hiding in Plain Sight: The Health Care Gender Toll” delves into the financial disparities women face in the U.S. healthcare system, often referred to as the “pink tax.” This term encompasses not only the higher prices women pay for consumer goods, but also the increased out-of-pocket healthcare expenses they incur compared to men.

According to the report, employed women in the U.S. spend approximately $15.4 billion more annually than their male counterparts. This disparity persists even when excluding pregnancy-related expenses. These financial burdens can have significant implications for women undergoing cancer treatment. The cumulative costs of diagnostics, therapies, and follow-up care can be substantial, and the existing disparities may exacerbate the challenges women face in accessing and affording necessary cancer care.

For a more detailed understanding , you may access the full Deloitte report HERE.

The report “Creating a Vision of Women-Centric Cancer Care,” developed from the 2023 FemTechnology Summit, provides actionable recommendations for employers and insurance companies to address gender-based financial disparities (the “pink tax”) in cancer care. The report can be found HERE.

In Section VII.E and detailed in the Appendix 2 of the report are the recommendations which include reassessing coverage policies, supporting comprehensive care, and advancing gender-inclusive benefits. The recommendations aim to mitigate the financial burdens disproportionately affecting women undergoing cancer treatment to promote equitable access to cancer care.

© Copyright 2024 Central Florida Health Care Coalition, Incorporated d/b/a Florida Alliance for Healthcare Value

The Central Florida Health Care Coalition, Incorporated d/b/a Florida Alliance for Healthcare Value is providing this information to our employer members solely in our capacity as a 501c3 nonprofit education organization and not as advice in any capacity. The information that is not in the public domain is private and confidential.